Fibonacci Retracements Analysis 22.06.2020 (GOLD, USDCHF)

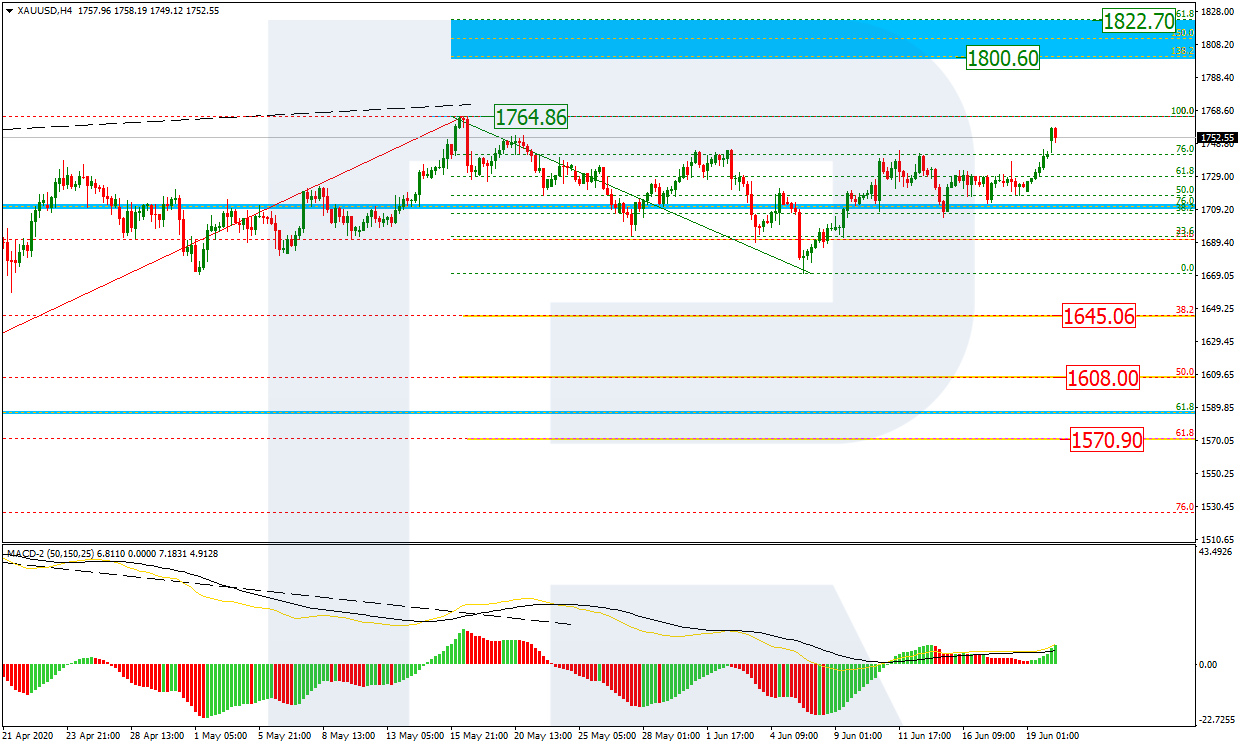

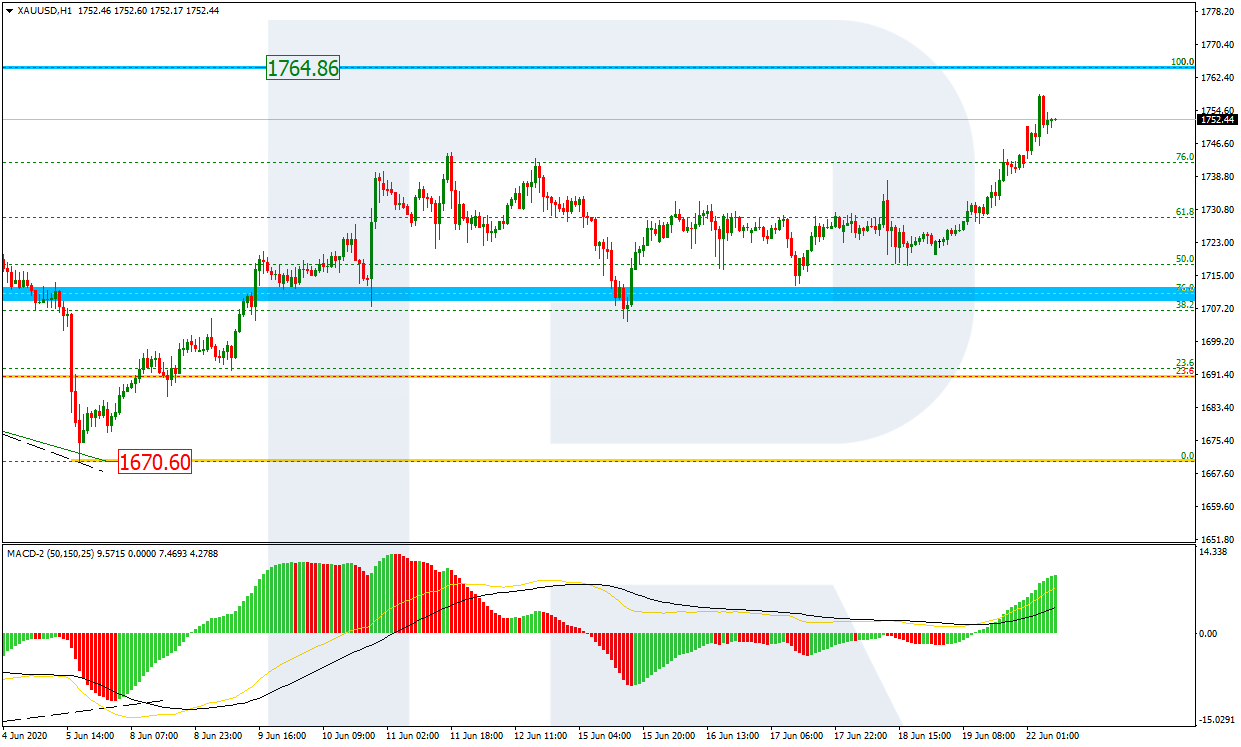

XAUUSD, “Gold vs US Dollar”

The H4 chart shows a new wave inside the uptrend; XAUUSD has reached the high at 1764.86. If the price breaks it, the pair may continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 1800.60 and 1822.70 respectively. However, if the asset fails to break the high, the instrument may continue the correction. Hence, one can expect a new decline towards 38.2%, 50.0%, and 61.8% fibo at 1645.06, 1608.00, and 1570.90 respectively.

As we can see in the H1 chart, after breaking the consolidation range, XAUUSD is quickly growing towards the high at 1764.86. The key support here is at the short-term fractal low (1670.60). At the same time, there might be a divergence on MACD to indicate a possible rebound from the high.

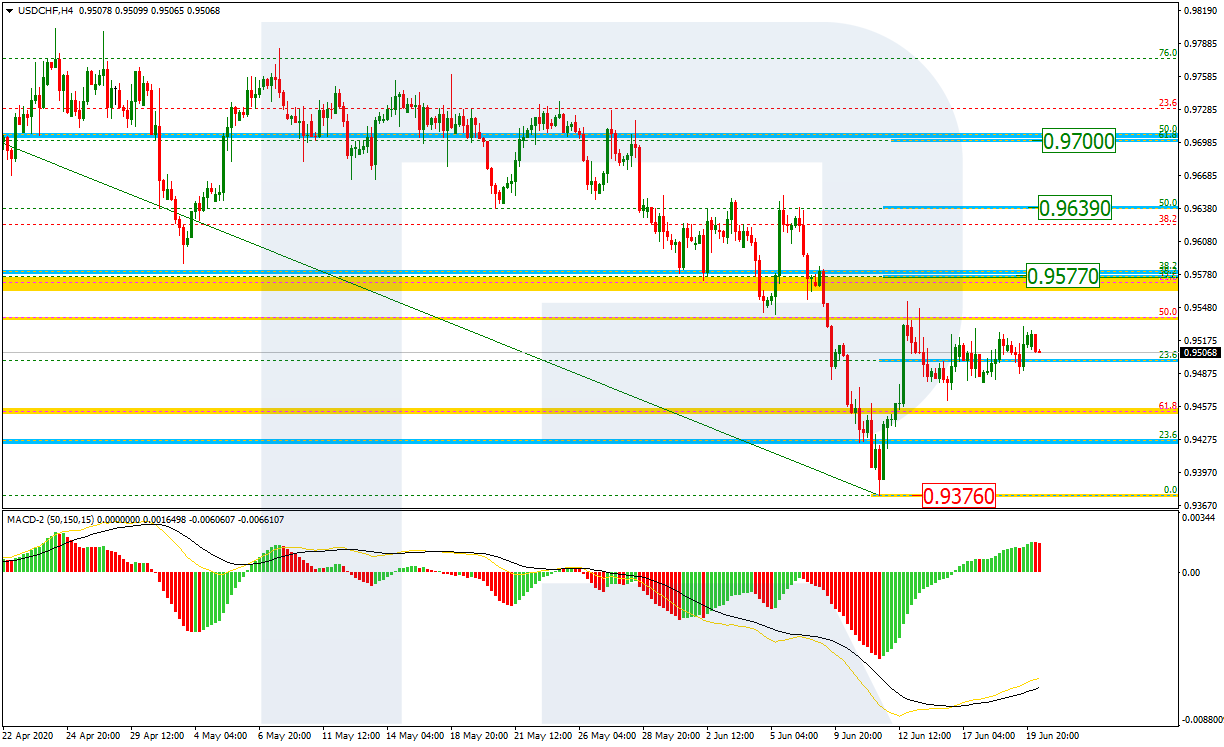

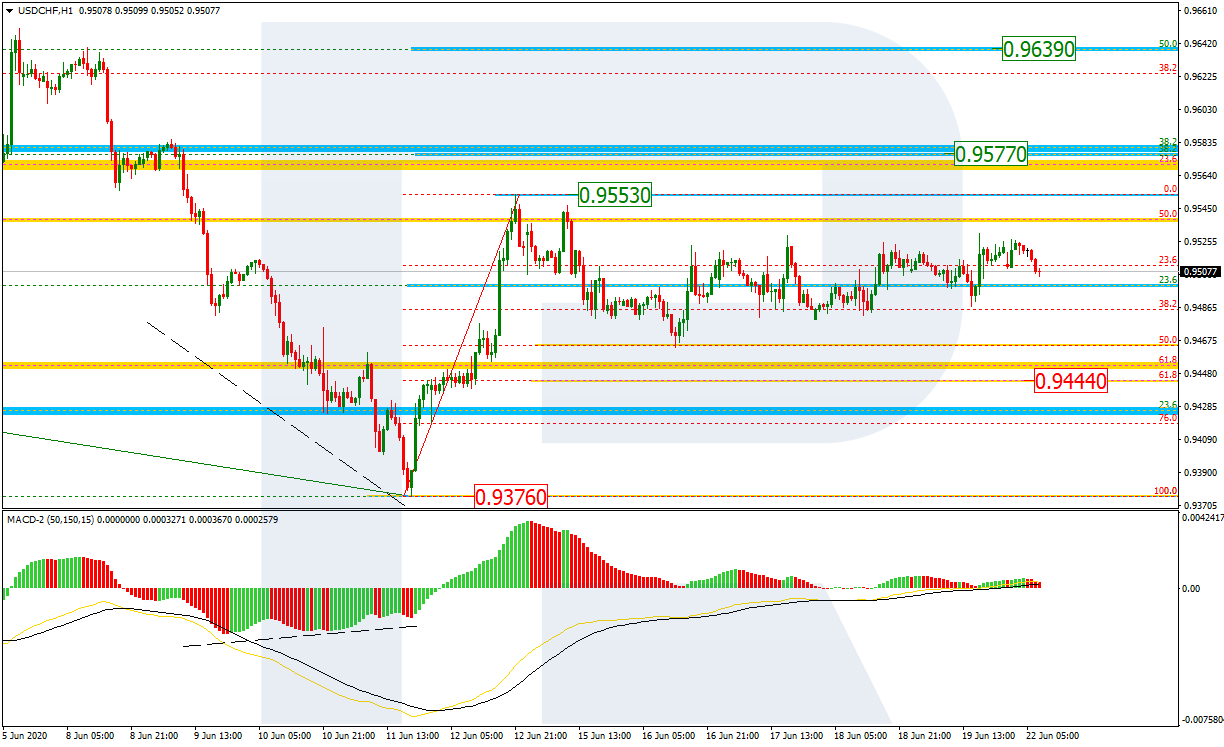

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after finishing the first rising wave, USDCHF is correcting within a Triangle pattern around 23.6% fibo. If the price breaks the pattern’s upside border, the pair may continue trading upwards towards 38.2%, 50.0%, and 61.8% fibo at 0.9577, 0.9639, and 0.9700 respectively. The support is the low at 0.9376.

The H1 chart shows a more detailed structure of the current correction after the ascending impulse. The first rising wave has been corrected by 50.0%. Later, the pair may continue falling towards 61.8% fibo at 0.9444. However, if the instrument breaks the high at 0.9553, the mid-term uptrend may resume.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.